Other factors, for instance our have proprietary Web page policies and no matter whether a product is obtainable close to you or at your self-chosen credit score array, might also affect how and exactly where products look on This website. Whilst we attempt to deliver a variety of features, Bankrate will not involve information about every single fiscal or credit service or product.

A business line of credit is a flexible business loan that actually works similarly to a business credit card. Borrowers are approved up to a particular amount of money and will draw on their line of credit as desired, having to pay curiosity only on the amount actively borrowed. Money are generally obtainable via a business checking account or cellular app.

A business line of credit is usually a sort of small-business loan that provides entry to a pool of cash to draw from after you want capital. An actual upside to this manner of financing is you don’t make payments or incur curiosity till you actually faucet in the funds.

Cost savings account guideBest savings accountsBest significant-produce price savings accountsSavings accounts alternativesSavings calculator

Conducting complete research is critical before committing into a lender. This action helps be sure that you choose a trustworthy lender and prevent likely concerns:

Before you decide to embark over the journey to secure a small business loan, it’s necessary to have a radical comprehension of your business and its needs. This will involve assessing your business’s present-day state, current market place, and potential prospective clients.

Create a Budget: Generate and adhere to the funds that aligns using your business targets. A well-planned spending budget can help control costs, allocate assets efficiently, and be sure that loan repayments are created in time.

In case you apply using a bank or credit union, you might have to visit a branch to accomplish and submit your application. Online or private business loans, However, offer a streamlined, digital application knowledge.

Networking and developing relationships with likely lenders can improve your probabilities of securing a loan. Establishing a strong rapport with lenders can provide various advantages:

Backed via the U.S. Small Business Administration (SBA), the SBA loan application features reduced fascination rates and reasonable repayment terms to borrowers who wouldn’t or else qualify for small business financing.

Usually, the resources are deposited on the exact same working day or inside a few business days. Compared, an SBA or regular bank loan is a lot more time intensive, with funding situations lasting approximately ninety times.

Kapitus’s borrowers often experienced optimistic encounters with the lender, noting the quick and effective funding course of action as well as beneficial customer service. Nonetheless, there were some customers who experienced considerations with regards to the high interest prices and fees.

New businesses devoid of a longtime credit record or solid business line of credit once-a-year income could take into account startup business loans from different and common lenders.

In depth fiscal projections are essential for demonstrating your business’s economic wellness and ability to repay the small business loan. Involve:

Bug Hall Then & Now!

Bug Hall Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Barbi Benton Then & Now!

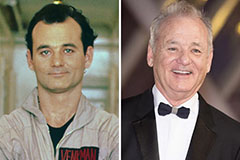

Barbi Benton Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!